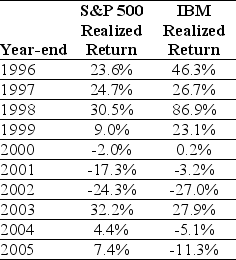

Use the table for the question(s) below.

Consider the following realized annual returns:

-The average annual return over the period 1926-2009 for small stocks is 22.1%,and the standard deviation of returns is 22.1%.Based on these numbers,what is a 95% confidence interval for 2010 returns?

A) 11.1%,33.2%

B) 0%,44.2%

C) -22.1%,44.2%

D) -22.1%,66.3%

E) -12.5%,45.7%

Correct Answer:

Verified

Q54: The Ishares Bond Index fund (TLT)has a

Q55: Use the table for the question(s)below.

Consider the

Q56: Use the table for the question(s)below.

Consider the

Q57: If the returns on a stock index

Q58: Treasury bill returns are 5%,4%,3%,and 6% over

Q60: Use the table for the question(s)below.

Consider the

Q61: There is an overall relationship between _

Q63: What is the expected payoff for Big

Q64: Rational investors may be willing to choose

Q66: Is volatility a reasonable measure of risk

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents