Charles and Charms, a merchandiser, has an account receivable for $125 which they now decided to be uncollectible. The merchandiser uses the direct write-off method. Which of the following entries is required to record the write-off?

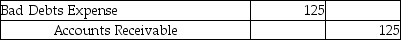

A)

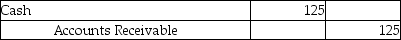

B)

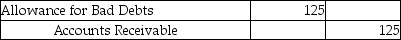

C)

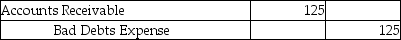

D)

Correct Answer:

Verified

Q24: For a company with significant uncollectible receivables,

Q25: The expense associated with the cost of

Q25: Tom's Fit Inc. a readymade garment seller

Q27: On January 1, Davidson Services has the

Q30: Tom's Fit Inc. a readymade garment seller

Q31: On January 1, Davidson Services has the

Q32: Which of the following is a disadvantage

Q53: Under the direct write-off method,the entry to

Q58: Under the direct write-off method,which of the

Q71: The direct write-off method for uncollectible accounts

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents