Aries and Eros start a partnership firm with capital contributions of $40,000 and $60,000, respectively. In course of the year, Aries withdraws $5,000 from the business in order to meet his personal expenses. Which of the following is the correct journal entry to record the above withdrawal?

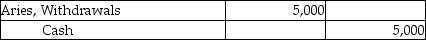

A)

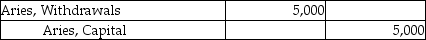

B)

C) No entry

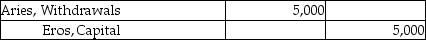

D)

Correct Answer:

Verified

Q81: When a new partner enters into a

Q88: Nancy and Betty enter into a partnership

Q89: In partnership, a person can become a

Q94: When a new partner is admitted to

Q96: The purchase of an existing partner's interest

Q97: Aries and Eros start a partnership firm

Q98: Kenny and Jeff formed a partnership business.

Q102: Irrespective of the original profit-and-loss-sharing ratio,the bonus

Q108: When a new partner is admitted at

Q109: When a partner sells his interest to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents