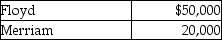

Floyd and Merriam start a partnership business on June 12, 2019. Their capital account balances as of December 31, 2020 stood as follows:  Floyd and Merriam share profits and losses equally. They agreed to dissolve the partnership and start a new one, admitting Ramelow for one-half share in the capital in exchange for land and equipment having a total market value of $70,000. Which of the following is the correct journal entry to record the introduction of Ramelow as a partner?

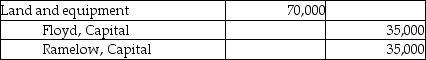

Floyd and Merriam share profits and losses equally. They agreed to dissolve the partnership and start a new one, admitting Ramelow for one-half share in the capital in exchange for land and equipment having a total market value of $70,000. Which of the following is the correct journal entry to record the introduction of Ramelow as a partner?

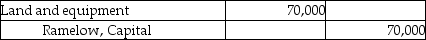

A)

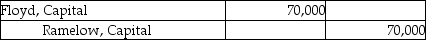

B)

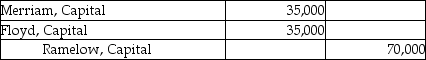

C)

D)

Correct Answer:

Verified

Q101: Which of the following is true of

Q107: Keith and Jim are partners. Keith has

Q107: Allan and Ralph are partners.Allan has a

Q108: Sarah and Jane formed a partnership with

Q109: Anna and Naomi are partners. Anna has

Q111: Ruby and Anita are partners. Ruby has

Q112: Floyd and Merriam start a partnership business

Q114: Rex and Sandy are partners. Rex has

Q115: Floyd and Merriam start a partnership business

Q131: Issac and Karl are partners.Issac has a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents