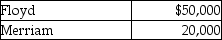

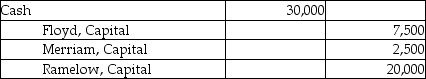

Floyd and Merriam start a partnership business on June 12, 2019. Their capital account balances as of December 31, 2020 stood as follows:  They agreed to admit Ramelow into the business for a one-fifth interest in the new partnership. He had to bring in a cash contribution of $30,000 for the same. Assuming that Floyd and Merriam shared profits and losses in the ratio 3:1 before the admission of Ramelow. Which of the following is the correct journal entry to record the above admission?

They agreed to admit Ramelow into the business for a one-fifth interest in the new partnership. He had to bring in a cash contribution of $30,000 for the same. Assuming that Floyd and Merriam shared profits and losses in the ratio 3:1 before the admission of Ramelow. Which of the following is the correct journal entry to record the above admission?

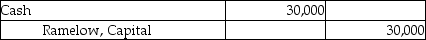

A)

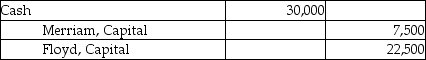

B)

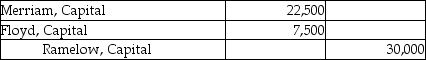

C)

D)

Correct Answer:

Verified

Q101: Which of the following is true of

Q112: Floyd and Merriam start a partnership business

Q114: Rex and Sandy are partners. Rex has

Q115: Floyd and Merriam start a partnership business

Q116: Keith and Jim are partners. Keith has

Q118: Which of the following is true when

Q119: Floyd and Merriam start a partnership business

Q120: Keith and Jim are partners. Keith has

Q121: Gary, Peter, and Chris and have capital

Q122: When an existing partner sells his interest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents