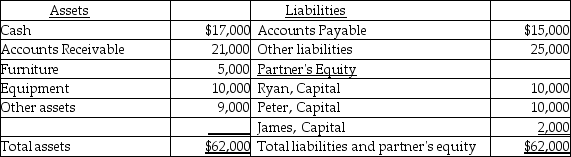

The balance sheet of Ryan, James and Peter firm as on December 31, 2014, is given below.  Ryan, Peter, and James share profits in the ratio 3:2:1. They have decided to liquidate the partnership with immediate effect. The furniture and the equipment were sold at a cumulative loss of $6,000. The accounts receivable were duly received in cash and the other assets were written off as worthless. The accounts payable and other liabilities were paid off at book value. James argued that he should receive a portion of the remaining cash, but Peter and Ryan argued otherwise. How much cash should James receive or pay?

Ryan, Peter, and James share profits in the ratio 3:2:1. They have decided to liquidate the partnership with immediate effect. The furniture and the equipment were sold at a cumulative loss of $6,000. The accounts receivable were duly received in cash and the other assets were written off as worthless. The accounts payable and other liabilities were paid off at book value. James argued that he should receive a portion of the remaining cash, but Peter and Ryan argued otherwise. How much cash should James receive or pay?

A) He should receive $2,500.

B) He should not receive or pay any money.

C) He should pay $7,500.

D) He should pay $500.

Correct Answer:

Verified

Q143: Before the start of the liquidation process,the

Q145: The process of going out of business

Q146: Capital deficiency occurs when a partner's capital

Q148: Which of the following is true of

Q150: The balance sheet of Ryan and Peter

Q151: While liquidating a partnership,the cash remaining after

Q152: The balance sheet of Ryan and Peter

Q153: Upon liquidation of a partnership, gains and

Q157: Hillary, Bruce, and Cindy own a partnership

Q158: The balance sheet of Ryan and Peter

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents