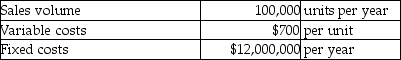

Meson Production is a price-taker. It produces large spools of electrical wire in a highly competitive market, so it practices target pricing. The current market price of the electric wire is $780 per unit. The company has $3,000,000 in assets and its shareholders expect a return of 6% on assets. The company provides the following information:  If variable costs cannot be reduced, how much reduction in fixed costs will be needed to achieve the profit target?

If variable costs cannot be reduced, how much reduction in fixed costs will be needed to achieve the profit target?

A) $4,180,000

B) $12,000,000

C) $7,820,000

D) $4,200,000

Correct Answer:

Verified

Q63: In making product mix decisions under constraining

Q64: The income statement for Sweet Dreams Company

Q65: Freemen Company's western territory's forecasted income statement

Q66: A company sells two products with information

Q67: Meson Production is a price-taker. It produces

Q69: Which of the following statements is true?

A)Companies

Q70: Sand Corporation manufactures two styles of lamps:

Q71: Faros Hats, Etc. has two product lines-baseball

Q72: If a company wishes to be a

Q73: A company has two different products that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents