John wins the lottery and has the following three payout options for after-tax prize money: 1. $150,000 per year at the end of each of the next six years

2. $300,000 (lump sum) now

3. $500,000 (lump sum) six years from now

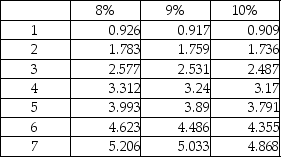

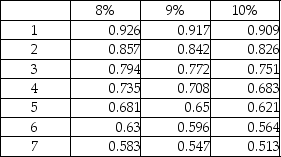

The required rate of return is 9%. What is the present value if he selects the first option? Round to nearest whole dollar.

Present value of annuity of $1:  Present value of $1:

Present value of $1:

A) $750,000

B) $672,900

C) $450,000

D) $450,050

Correct Answer:

Verified

Q71: Lara is going to receive $10,000 a

Q72: Paramount Company is considering purchasing new equipment

Q73: Paramount Company is considering purchasing new equipment

Q74: Net present value is defined as the

Q77: The only difference between present value and

Q78: John wins the lottery and has the

Q79: Nylan Manufacturing is considering two alternative investment

Q80: The residual value is discounted as a

Q81: Gamma Company is considering an investment of

Q101: Management's minimum desired rate of return on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents