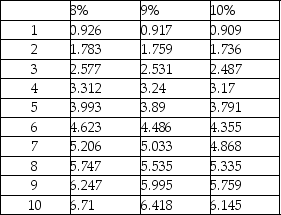

A company is considering an iron ore extraction project which requires an initial investment of $500,000 and will yield annual cash flows of $150,000 for 4 years. The company's hurdle rate is 9%. What is the NPV of the project?

A) positive $14,000

B) negative $100,000

C) positive $100,000

D) negative $14,000

Correct Answer:

Verified

Q79: Nylan Manufacturing is considering two alternative investment

Q80: The residual value is discounted as a

Q81: Gamma Company is considering an investment of

Q82: Compound interest used in discounted cash flow

Q83: The NPV method of evaluating capital investments

Q85: Gamma Company is considering an investment proposal

Q86: When calculating the net present value of

Q87: Which of the following is true of

Q88: When evaluating a potential investment, managers should

Q89: When a company is evaluating an investment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents