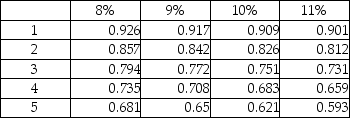

Gladeer Company is evaluating an investment that will cost $520,000 and will yield cash flows of $300,000 in the first year, $200,000 in the second year, and $100,000 in the third and final year. Use the tables below and determine the internal rate of return. Present value of $1:  The IRR of the project will be:

The IRR of the project will be:

A) between 9% and 10%.

B) less than 8%

C) less than 9%, more than 8%

D) more than 10%

Correct Answer:

Verified

Q97: Discounted cash flow methods consider the time

Q98: Which of the following situations suggests the

Q99: Out of all methods of evaluating capital

Q100: Which of the following is true of

Q101: The following details are provided by Dopler

Q103: A company is considering an iron ore

Q105: The following details are provided by Dopler

Q106: Under conditions of limited resources, when a

Q107: The following details are provided by Dopler

Q120: Which of the following best describes the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents