Gamma Company is considering an investment opportunity with the following expected net cash inflows: Year 1, $250,000; Year 2, $350,000; Year 3, $395,000. Residual value of the investment would be $50,000. The company uses a discount rate of 12% and the initial investment is $400,000. Calculate the NPV of the investment.

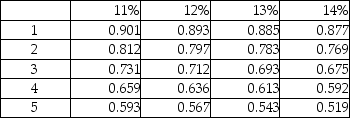

Present value of $1:

Correct Answer:

Verified

Q112: Which of the following best describes the

Q113: Which of the following best describes the

Q114: Nobell Company is evaluating an investment of

Q115: Which of the following is the rate

Q116: A company seeking investment opportunities has collected

Q117: Canbera Company is considering investing $450,000 in

Q118: Following details are provided by VPN Company.

Q119: Which of the following would be the

Q120: The following details are provided by Dopler

Q121: Gamma Company is considering an investment opportunity

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents