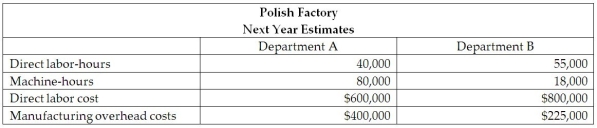

The Polish Factory manufactures natural resources in Ireland. At the beginning of 20XX, the accountant provided the following estimates associated with Department A and Department B for the coming year:

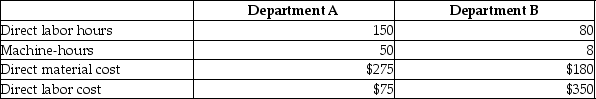

According to the reports provided by the manager at the Polish Factory, the following data was presented to represent a job that was completed during the year:

According to the reports provided by the manager at the Polish Factory, the following data was presented to represent a job that was completed during the year:

Assume that the Polish Factory uses departmental cost driver rates to allocate manufacturing overhead to products. The manufacturing overhead costs are allocated on the basis of machine-hours in Department A on the basis of direct labor-hours in Department B. First, compute the annual manufacturing cost-allocation rate for Department A. What are the total manufacturing costs associated with the job and what is the amount the manager at the Polish Factory should allocate to the job?

Assume that the Polish Factory uses departmental cost driver rates to allocate manufacturing overhead to products. The manufacturing overhead costs are allocated on the basis of machine-hours in Department A on the basis of direct labor-hours in Department B. First, compute the annual manufacturing cost-allocation rate for Department A. What are the total manufacturing costs associated with the job and what is the amount the manager at the Polish Factory should allocate to the job?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q308: Since a service firm does not carry

Q309: Matthew Company uses a job cost system.

Q310: The main driver of indirect costs for

Q311: The most significant cost for a service

Q312: Manufacturing overhead has an underallocated balance of

Q314: A company has overallocated manufacturing overhead by

Q315: A service firm's costs are comprised of

Q316: Here is selected data for Betty Boo

Q317: Here is selected data for Betty Boo

Q318: On the line in front of each

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents