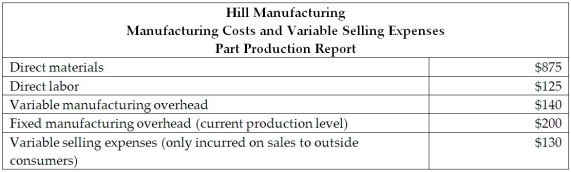

Hill Manufacturing is a large manufacturer that produces a part that inserts into diesel engines. The company has several large divisions and the managerial accountant reported the part is currently produced in the assembly department. The managerial accountant reported that the variable selling expenses and manufacturing costs related to the production of this part include the following:

Another department at Hill Manufacturing is set up to produce the diesel part and could produce the part internally rather than purchase the part from an outside supplier. The managerial accountant reported that the other department has excess capacity and could produce the part in that department. There is a significant amount of competition in the marketplace and the current price to produce the part at the other internal department and a competitor is $1,500.

Another department at Hill Manufacturing is set up to produce the diesel part and could produce the part internally rather than purchase the part from an outside supplier. The managerial accountant reported that the other department has excess capacity and could produce the part in that department. There is a significant amount of competition in the marketplace and the current price to produce the part at the other internal department and a competitor is $1,500.

What is the highest transfer price that the managerial accountant should pay to purchase the part from a competitor? Calculate the lowest acceptable transfer price if the part was produced by the internal operations at the other department at Hill Manufacturing.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q148: Which of the strategies listed are used

Q149: The Jazz Division of Heights Recording Corporation

Q150: The practice of purchasing other companies within

Q151: Transfer price is the term used to

Q152: Selected financial data for the Photocopies Division

Q154: Marble Countertops and Cabinet Manufacturing produces marble

Q155: The Pasta Division of Whole Grain Corporation

Q156: Selected financial data for the Photocopies Division

Q157: Shining Springs Glass Art manufactures various glass

Q158: Selected financial data for the Photocopies Division

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents