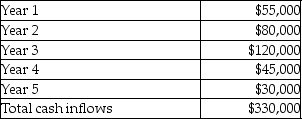

Landrum Corporation is considering investing in specialized equipment costing $260,000. The equipment has a useful life of 5 years and a residual value of $15,000. Depreciation is calculated using the straight-line method. The expected net cash inflows from the investment are:  Landrum Corporation's required rate of return on investments is 20%.

Landrum Corporation's required rate of return on investments is 20%.

What is the accounting rate of return on the investment?

A) 6) 54%

B) 5) 15%

C) 18.85%

D) 25.38%

Correct Answer:

Verified

Q43: The Crystal Company uses straight-line depreciation and

Q44: Redwood Corporation is considering two alternative investment

Q45: Redwood Corporation is considering two alternative investment

Q46: Matthew Corporation is adding a new product

Q47: The Silverside Company is considering investing in

Q49: The Crystal Company uses straight-line depreciation and

Q50: The Silverside Company is considering investing in

Q51: The Crystal Company uses straight-line depreciation and

Q52: Suppose Whole Foods is considering investing in

Q53: The Silverside Company is considering investing in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents