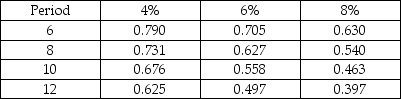

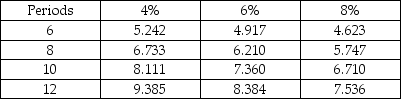

Mystic Metal Stamping is analyzing a special investment project. The project will require the purchase of two machines for $25,000 and $10,000 (both machines are required) . The total residual value at the end of the project is $1000. The project will generate cash inflows of $11,000 per year over its 10-year life. If Mystic requires a 6% return, what is the net present value (NPV) of this project? Present Value of $1 Present Value of Annuity of $1

Present Value of Annuity of $1

A) $45,960

B) $16,243

C) $15,380

D) $46,518

Correct Answer:

Verified

Q149: A company would consider all of the

Q150: Glassworks Inc. is considering the purchase of

Q151: Justice Enterprises is evaluating the purchase of

Q152: Westin Manufacturing is considering the purchase of

Q153: Another name for the minimum desired rate

Q155: Interior Products, Inc. is evaluating the purchase

Q156: The profitability index is calculated by dividing

Q157: The net present value with equal annual

Q158: Vino Winery is considering the purchase of

Q159: The general rule when using the Internal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents