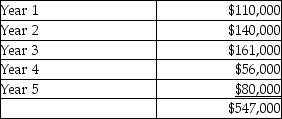

Somerville Corporation is considering investing in specialized equipment costing $616,000. The equipment has a useful life of 5 years and a residual value of $52,000. Depreciation is calculated using the straight-line method. The expected net cash inflows from the investment are:  Somerville Corporation's required rate of return is 12%.

Somerville Corporation's required rate of return is 12%.

The net present value of the investment is closest to:

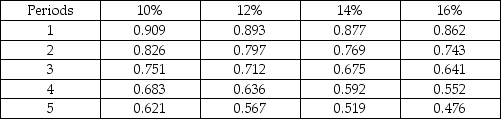

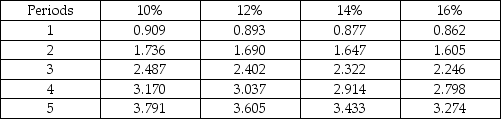

Present Value of $1 Present Value of Annuity of $1

Present Value of Annuity of $1

A) $181,098 positive.

B) $181,098 negative.

C) $39,123 negative.

D) $69,000 positive.

Correct Answer:

Verified

Q161: Somerville Corporation is considering investing in specialized

Q162: O'Mally Department Stores is considering two possible

Q163: The Pantry Vending Machine Company is looking

Q164: O'Mally Department Stores is considering two possible

Q165: Cleveland Cove Enterprises is evaluating the purchase

Q167: The Pantry Vending Machine Company is looking

Q168: Dandy's Fun Park is evaluating the purchase

Q169: Cleveland Cove Enterprises is evaluating the purchase

Q170: Cleveland Cove Enterprises is evaluating the purchase

Q171: Sunny Days Corporation is deciding whether to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents