The Cookies Bakery Company managerial accountant considers the purchase of a new convection oven system. A preferred vendor offers two plausible options, the Tech-Smart convection system (TSCS)and the Perfection Convection Solution Series 3 (PCS3). Both convection systems have a useful life of 12 years. The TSCS requires an initial investment of $250,000 whereas the PCS3 requires an initial investment of $330,000. The energy efficient technology of the TSCS is projected to increase total revenue $38,000 annually while the precise production capability of the PCS3 is projected to increase revenue $52,000 annually. The Managerial accountant plans to invest the cash inflow in an annuity yielding 8%. Compare the net present value of each new system and state which investment is more beneficial to Cookies Bakery Company.

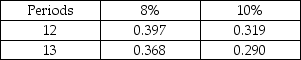

Present Value of $1

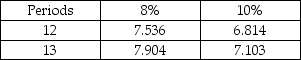

Present Value of Annuity of $1

Present Value of Annuity of $1

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q181: Dandy's Fun Park is evaluating the purchase

Q182: The ARR is the only method that

Q183: Neither the payback period nor the IRR

Q184: The Internal Rate of Return, the Accounting

Q185: Dandy's Fun Park is evaluating the purchase

Q187: Velocity Tire Company's managerial accountant assesses the

Q188: Leonardo Company is deciding whether to automate

Q189: Dandy's Fun Park is evaluating the purchase

Q190: Louise owns a golf course and wants

Q191: Companies often use more than one capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents