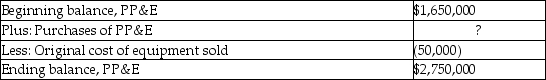

The managerial accountant at the Holiday Musical Academy is required to complete the statement of cash flows. The managerial accountant is required to determine the amount of money the company used to purchase property, plant, and equipment (PP&E) during the year. The balance of PP&E at the beginning of the year is $1,650,000 and the balance of PP&E at the end of the year is $2,750,000. The managerial accountant reviewed the general journal and noticed that the original cost of equipment sold during the year was $50,000. Using the following information, calculate the amount of cash the company paid in cash to purchase new property, plant, and equipment during the year:

A) $50,000

B) $1,650,000

C) $1,150,000

D) $2,750,000

Correct Answer:

Verified

Q152: A company sells equipment at a loss.

Q153: When a company uses the direct method

Q154: The only difference in a statement of

Q155: Which of the following would be presented

Q156: The only difference in a statement of

Q158: A company purchases land using its common

Q159: The only difference in a statement of

Q160: A company acquires its own stock to

Q161: Which of the following would not appear

Q162: A company uses the direct method to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents