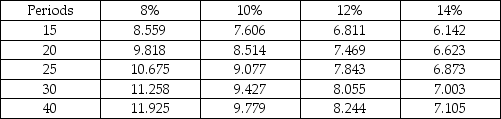

(Net present value table required) Windy Industries, in Chicago, plans to take advantage of the winds blowing in from Lake Michigan. Windy is developing a project to install a wind turbine that would generate electricity and reduce energy costs. The turbine would have an initial cost of $550,000 and would provide a net cost savings of $62,000 per year. The turbine will have a life of 25 years. If Windy assigns a discount rate of 10% to this project, what is the net present value (NPV) of the wind turbine?

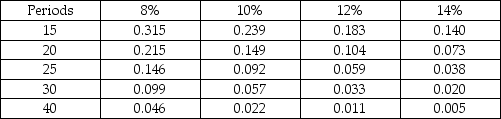

Present Value of $1 Present Value of Annuity of $1

Present Value of Annuity of $1

A) $12,774

B) -$12,774

C) $1,112,774

D) $550,000

Correct Answer:

Verified

Q28: Gluck Metal Works stamps sheet metal into

Q29: Gluck Metal Works stamps sheet metal into

Q30: Windy Industries, in Chicago, plans to take

Q31: R-Cubed manufactures custom playground equipment from recycled

Q32: When a company makes purchasing decisions based

Q34: Which of the following is not an

Q35: Rubber City Cycles manufactures carbon fiber bicycle

Q36: A common definition of _ is the

Q37: Which of the following is not considered

Q38: The term _ has been used to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents