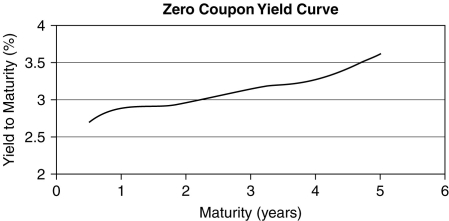

Use the figure for the question(s) below.

-A risk-free, zero-coupon bond has 15 years to maturity. Which of the following is closest to the price per $100 of face value that the bond will trade at if the YTM is 7%?

A) $38.78

B) $36.24

C) $32.68

D) $29.55

Correct Answer:

Verified

Q23: Under what situation can a zero-coupon bond

Q31: Consider a zero-coupon bond with a $1

Q31: How are the cash flows of a

Q33: Which of the following statements is FALSE?

A)The

Q34: Which of the following statements is FALSE?

A)Because

Q35: Consider a zero-coupon bond with a $1

Q38: Under what situation can a zero-coupon bond

Q38: The yield to maturity for the two-year

Q39: Based upon the information given above, you

Q41: What must be the price of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents