Use the information for the question(s) below.

-A firm issues 20-year bonds with a coupon rate of 4.8%, paid semi-annually. The credit spread for this firm's 20-year debt is 1.2%. New 20-year Treasury bonds are being issued at par with a coupon rate of 4.6%. What should the price of the firm's outstanding 20-year bonds be if their face value is $1 000?

A) $882.53

B) $975.98

C) $1 000.86

D) $977.48

Correct Answer:

Verified

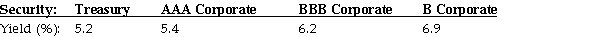

Q84: Use the table for the question(s)below.

Consider the

Q85: What rating must Luther receive on these

Q86: Use the information for the question(s)below.

Q87: Use the information for the question(s)below.

Luther Industries

Q88: Use the information for the question(s)below.

Luther Industries

Q90: Why are the interest rates of Treasury

Q91: Use the information for the question(s)below.

Luther Industries

Q92: Use the information for the question(s)below.

Luther Industries

Q93: Use the information for the question(s)below.

Q94: Use the information for the question(s)below.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents