Use the information for the question(s) below.

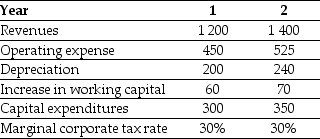

Shepard Industries is evaluating a proposal to expand its current distribution facilities. Management has projected the project will produce the following cash flows (in millions) for the first two years.

-The depreciation tax shield for the Shepard Industries project in year 2 is closest to:

A) $60

B) $96

C) $72

D) $84

Correct Answer:

Verified

Q48: Use the information for the question(s)below.

Epiphany Industries

Q49: Use the information for the question(s)below.

Shepard Industries

Q50: Use the information for the question(s)below.

Temporary Housing

Q51: Use the table for the question(s)below.

Q52: Use the information for the question(s)below.

The Sisyphean

Q54: Use the information for the question(s)below.

Epiphany Industries

Q55: Use the information for the question(s)below.

Epiphany Industries

Q57: Use the information for the question(s)below.

Epiphany Industries

Q58: Use the information for the question(s)below.

Temporary Housing

Q94: What are project externalities?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents