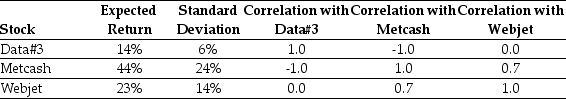

Use the table for the question(s) below.

Consider the following expected returns, volatilities and correlations:

-A share market comprises 5 000 shares of company A and 2 000 shares of company B. Assume the share prices for companies A and B are $20 and $35, respectively. What is the capitalisation of the market portfolio?

A) $165 000

B) $170 000

C) $150 000

D) $185 000

Correct Answer:

Verified

Q36: A portfolio has 10% of its value

Q37: The volatility of Woolworth's share price is

Q38: Use the information for the question(s)below.

Suppose you

Q39: If two shares are perfectly negatively correlated,

Q40: Use the information for the question(s)below.

Suppose you

Q42: Use the table for the question(s)below.

Consider the

Q43: Use the table for the question(s)below.

Consider the

Q44: Use the table for the question(s)below.

Consider the

Q45: Use the table for the question(s)below.

Consider the

Q46: Which of the following equations is INCORRECT?

A)Cov(Ri,Rj)=

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents