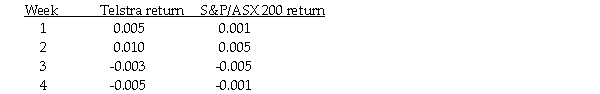

You observe that Telstra shares and the S&P/ASX 200 index have the following weekly returns:  If this pattern of returns is typical of Telstra shares, and you calculated a beta against the S&P/ASX 200, which of the following is true?

If this pattern of returns is typical of Telstra shares, and you calculated a beta against the S&P/ASX 200, which of the following is true?

A) Telstra's beta is zero.

B) Telstra's beta is positive.

C) Telstra's beta is negative.

D) Cannot be determined from information given.

Correct Answer:

Verified

Q66: For each 1% change in the market

Q67: You expect Wesfarmers (WES)to have a beta

Q68: Which of the following statements is FALSE?

A)We

Q69: What diversification, if any, is achieved if

Q70: Companies that sell household products and food

Q72: The market portfolio is the portfolio of

Q73: The S&P 500 index traditionally is a(n)_

Q74: If you build a large enough portfolio,

Q75: A linear regression was done to estimate

Q76: The security market line is a graph

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents