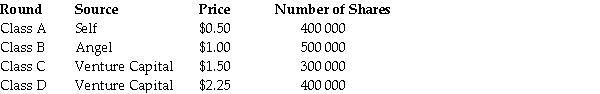

David founds a company and goes through the investment rounds shown below:  He decides to take the company public through an IPO, issuing 2 million new shares. Assuming that he successfully completes the IPO, the net income for the next year is estimated to be $8 million. His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses, which is 15.0. What share of the company will David own after the IPO?

He decides to take the company public through an IPO, issuing 2 million new shares. Assuming that he successfully completes the IPO, the net income for the next year is estimated to be $8 million. His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses, which is 15.0. What share of the company will David own after the IPO?

A) 22%

B) 11%

C) 16%

D) 14%

Correct Answer:

Verified

Q53: The founders and owners of a private

Q54: The founder of a company currently holds

Q55: In its IPO, Jillian's Imprints, a small

Q56: Which of the following statements is FALSE?

A)The

Q57: Which of the following statements is FALSE?

A)In

Q63: A seasoned equity offering is when a

Q66: How does IPO pricing puzzle financial economists?

Q72: Managers will try to protect their existing

Q76: What are some of the advantages of

Q78: What are some of the disadvantages of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents