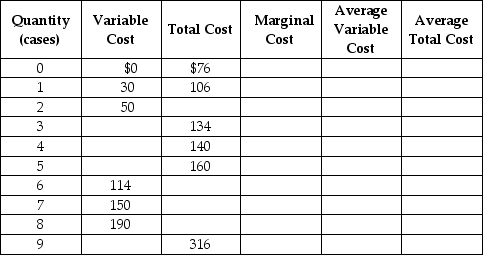

Werner & Sons is a manufacturer of three-ring binders operating in a perfectly competitive industry. Table 8-5 shows the firm's cost schedule.

Table 8-5

Use the table to answer the following questions.

Use the table to answer the following questions.

a. Complete Table 8-5 by filling in the blank cells.

b. Werner is selling in a perfectly competitive market at a price of $40. What is the profit maximising or loss-minimising output?

c. Calculate the firm's profit or loss.

d. Should the firm continue to produce in the short run? Explain.

e. If the firm's fixed costs were $30 higher, what would be the profit-maximising output level in the short run? Indicate whether the output level will increase, decrease or remain unchanged compared to your answer in b.

f. Suppose fixed cost remains at $76. If the price of three-ring binders falls to $20 what is the profit-maximising or loss-minimising output?

g. Calculate the profit or loss. Should the firm continue to produce in the short run? Explain your answer.

h. Suppose the fixed cost remains at $76. What price corresponds to the shut-down point?

i. Suppose the fixed cost remains at $76. What price corresponds to the break-even point?

Correct Answer:

Verified

c. Profit = ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q184: Figure 8.9 Q189: Figure 8.13 Q190: Figure 8.10 Q201: The short-run supply curve for a perfectly Q206: Under what conditions should a competitive firm Q210: Which of the following statements is correct? Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()

A)Economic