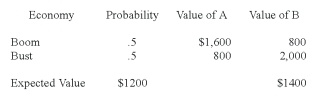

Firm A does well in a boom economy. Firm B does well in a bust economy. The probability of a boom is 50%. The end of period values of the two firms depend on the economy as shown below:  Both firms have debt outstanding with a face value of $1,000. In order to diversify, the two firms have proposed a merger. The NPV of the merger is zero. Which of the following statements is correct?

Both firms have debt outstanding with a face value of $1,000. In order to diversify, the two firms have proposed a merger. The NPV of the merger is zero. Which of the following statements is correct?

A) The stockholders are indifferent to merger since the NPV is zero.

B) The bondholders are indifferent to merger since the NPV is zero.

C) The bondholders stand to gain because the risk of the combined firm is less.

D) The stockholders stand to gain because the probability of bankruptcy becomes zero after the merger.

Correct Answer:

Verified

Q16: The positive incremental net gain associated with

Q21: The Albatross Co. has accumulated net operating

Q22: A merger should not take place simply

Q28: Cowboy Curtiss' Cowboy Hat Company recently completed

Q29: If two leveraged firms merge, the cost

Q30: The market for corporate control is a

Q32: When the management and/or a small group

Q34: A modification to the corporate charter that

Q35: Which of the following is not true

Q37: When two firms merge and there is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents