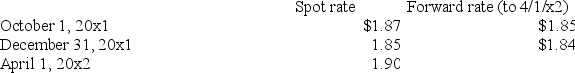

Amazing Corporation, a U.S. enterprise, sold product to a customer in Wales on October 1, 20x1 for £100,000 with payment required on April 1, 20x2. Relevant exchange rates are:  The discount factor corresponding to the company's incremental borrowing rate for 6 months is 0.95.

The discount factor corresponding to the company's incremental borrowing rate for 6 months is 0.95.

Assuming that Amazing Corporation does not hedge this transaction, what is the amount of exchange gain or loss that it should show on its December 31, 2001 income statement?

A) Loss $1,000

B) Loss $2,000

C) Gain $1,000

D) Gain $1,900

Correct Answer:

Verified

Q18: The central bank of Country X buys

Q19: Why was there very little fluctuation in

Q20: King's Bank, a British company, purchases market

Q21: On November 1, 2001 Zamfir Company, a

Q22: Amazing Corporation, a U.S. enterprise, sold product

Q24: When two parties from different countries enter

Q25: Amazing Corporation, a U.S. enterprise, sold product

Q26: What is the intrinsic value of a

Q27: What has occurred when one company purchases

Q28: On November 1, 2001 Zamfir Company, a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents