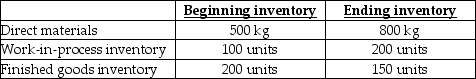

Use the information below to answer the following question(s) .Samson Inc.expects to sell 10,000 barbells for $18.00 each.Direct materials costs are $5.00, direct manufacturing labour is $6.00, and manufacturing overhead is $2.50 per barbell.Each barbell requires 6 kilograms (kg) of material which is all added at the start of production.The units in work-in-process beginning and ending inventory were half complete as to direct labour and manufacturing overhead costs; the units in beginning inventory are completed before new units are started..Each barbell requires one-quarter hour of direct labour, and manufacturing overhead is allocated based on direct labour hours.Marketing costs are $2.00 per barbell.The following inventory levels are expected to apply to 2019:

-On the 2019 budgeted income statement, what amount will be reported for gross margin?

A) $45,000

B) $70,000

C) $25,000

D) $40,000

E) $35,000

Correct Answer:

Verified

Q94: Use the information below to answer the

Q95: Use the information below to answer the

Q96: Budget Corporation has the following budgeted sales

Q97: Nittany Company sells three products with the

Q98: The Doran Company prepared the following revenue

Q100: Use the information below to answer the

Q101: Accrual accounting in compliance with ASPE/IFRS results

Q102: Boone Hobbies, a wholesaler, has a sales

Q103: The cash cycle describes the movement of

Q104: Barrieland Merchandising Firm is developing its budgets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents