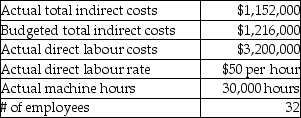

Use the information below to answer the following question(s) .The following data were taken from the records of Big Sky Ltd., a manufacturing company.The company has been calculating the actual indirect cost allocation rate using direct labour hours as the allocation base.

-Normandeau Company's actual indirect cost pool amounted to $1,400,000 and the direct labour pool was $5,400,000.Overhead is allocated on the basis of direct labour hours.Actual and budgeted direct labour hours were 25,000 and 30,000 for the period.What is the manufacturing overhead cost allocation rate using actual direct labour hours as the cost allocation base?

A) $46.67

B) $272.00

C) $75.00

D) $226.67

E) $56.00

Correct Answer:

Verified

Q91: John wants to identify the total cost

Q92: A local attorney employs ten full-time professionals.The

Q93: Cowley County Hospital uses a job-costing system

Q94: A local engineering firm is bidding on

Q95: AC Manufacturing is a small textile manufacturer

Q97: Beacon Company does residential real estate appraisals.There

Q98: Camden Company gathered the following information for

Q99: Fox Manufacturing is a small textile manufacturer

Q100: A local attorney employs ten full-time professionals.The

Q131: The Work-in-Process Control account tracks job costs

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents