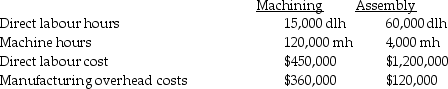

Valley Manufacturing uses departmental cost driver rates to apply manufacturing overhead costs to products.Manufacturing overhead costs are applied on the basis of machine hours in the Machining Department and on the basis of direct labour hours in the Assembly Department.The following estimates were provided at the beginning of the current year:

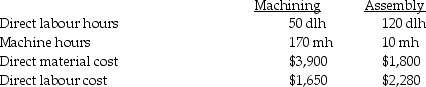

The accounting records of the company show the following data for Job #922:

The accounting records of the company show the following data for Job #922:

Required:

Required:

a.Compute the manufacturing indirect cost allocation rate for each department.

b.Compute the total cost of Job #922.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q68: What is the difference between an actual

Q109: Hill Manufacturing uses departmental cost driver rates

Q110: For each item below indicate the source

Q111: Instead of proration, a company could choose

Q112: For each item below indicate the source

Q113: Explain how a budgeted indirect cost allocation

Q115: For each item below indicate the source

Q116: For each item below indicate the source

Q117: For each item below indicate the source

Q118: Sambell Manufacturing uses a predetermined manufacturing overhead

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents