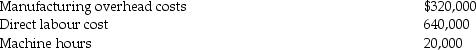

Northern Manufacturing uses a predetermined manufacturing overhead rate to allocate

overhead to individual jobs.At the beginning of the year, the company expected to incur the following:

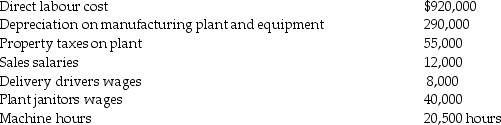

At the end of the year, the company had actually incurred the following:

At the end of the year, the company had actually incurred the following:

Required:

Required:

1.Compute Northerns's indirect cost allocation rate based on labour cost.2.Compute Northerns's indirect cost allocation rate based on machine hours.3.How much overhead was allocated during the year if the allocation base was machine hours?

4.How much manufacturing overhead was incurred during the year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q99: Fox Manufacturing is a small textile manufacturer

Q100: A local attorney employs ten full-time professionals.The

Q102: Proration is the equalization of the overhead

Q103: In a job-costing system, explain why it

Q105: An accounting firm provides tax consulting for

Q106: Sanders Company has two departments, X and

Q107: Jordan Company has two departments, X and

Q108: Underallocated indirect costs cannot occur when normal

Q109: Hill Manufacturing uses departmental cost driver rates

Q131: The Work-in-Process Control account tracks job costs

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents