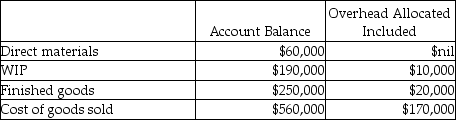

Use the information below to answer the following question(s) .Because the Abernathy Company used a budgeted indirect cost allocation rate for its manufacturing operations, the amount allocated ($200,000) was different from the actual amount incurred ($225,000) .These were the respective ending balances in the Manufacturing Overhead Allocated and Manufacturing Overhead control accounts.Before disposition of under/overallocated overhead, the following information was available:

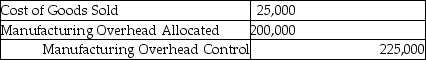

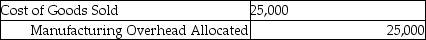

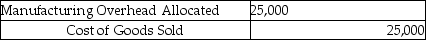

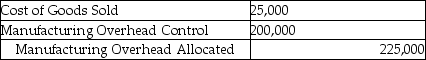

-What is the journal entry Abernathy Company should use to write-off the difference between allocated and actual overhead directly to cost of goods sold?

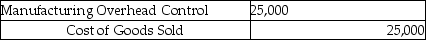

A)

B)

C)

D)

E)

Correct Answer:

Verified

Q136: Which method(s)for dealing with under/over allocated overhead

Q137: Which method for dealing with under/over allocated

Q138: XYZ Company uses a normal job costing

Q139: The balance in the manufacturing overhead allocated

Q140: Answer the following question(s)using the information below.Cloudy

Q142: Job-cost records for Boucher Company contained the

Q143: JamJee Enterprises uses a job costing system.Record

Q144: Moira Company has just finished its first

Q145: LaFleur Company has the following balances as

Q146: Schulz Corporation applies overhead based upon machine-hours.Budgeted

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents