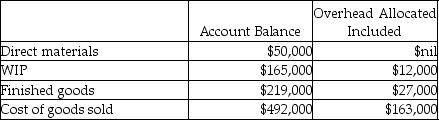

Use the information below to answer the following question(s) .Because the Beckworth Company used a budgeted indirect cost allocation rate for its manufacturing operations, the amount allocated ($190,000) was different from the actual amount incurred ($175,000) .These were the respective ending balances in the Manufacturing Overhead Allocated and Manufacturing Overhead control accounts.Before disposition of under/overallocated overhead, the following information was available:

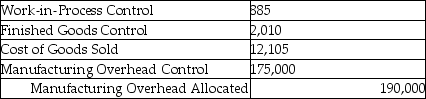

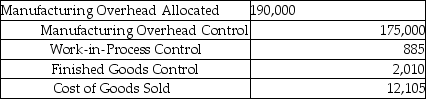

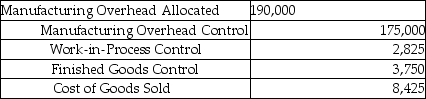

-What is the journal entry Beckworth Company should use to write-off the difference between allocated and actual overhead using the proration approach based on overhead allocated?

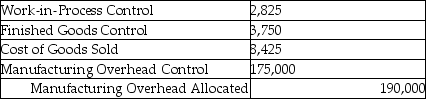

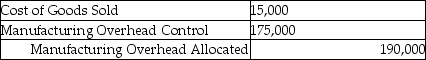

A)

B)

C)

D)

E)

Correct Answer:

Verified

Q149: Use the information below to answer the

Q150: LeBlanc Company has the following balances as

Q151: Klink Corporation applies overhead based upon machine-hours.Budgeted

Q152: Hogan Corporation applies overhead based upon machine-hours.Budgeted

Q155: Frankenreid Corporation uses a job costing system.Record

Q156: Use the information below to answer the

Q157: Indell Corporation uses a job costing system.Record

Q158: The Dougherty Furniture Company manufactures tables.In March,

Q159: What are three possible ways to dispose

Q159: Why does the Manufacturing Overhead Control account

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents