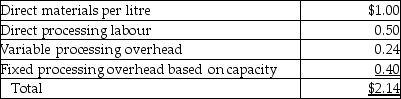

Better Food Company recently acquired an olive oil processing company that has an annual capacity of 2,000,000 litres and that processed and sold 1,400,000 litres last year at a market price of $4 per litre.The purpose of the acquisition was to furnish oil for the Cooking Division.The Cooking Division needs 800,000 litres of oil per year.It has been purchasing oil from suppliers at the market price.Production costs at capacity of the olive oil company, now a division, are as follows:

Management is trying to decide what transfer price to use for sales from the newly acquired company to the Cooking Division.The manager of the Olive Oil Division argues that $4, the market price, is appropriate.The manager of the Cooking Division argues that the cost of $2.14 should be used, or perhaps a lower price as fixed overhead cost should not be relevant.Any output of the Olive Oil Division not sold to the Cooking Division can be sold to outsiders for $4 per litre.Required:

Management is trying to decide what transfer price to use for sales from the newly acquired company to the Cooking Division.The manager of the Olive Oil Division argues that $4, the market price, is appropriate.The manager of the Cooking Division argues that the cost of $2.14 should be used, or perhaps a lower price as fixed overhead cost should not be relevant.Any output of the Olive Oil Division not sold to the Cooking Division can be sold to outsiders for $4 per litre.Required:

a.Compute the operating income for the Olive Oil Division using a transfer price of $4.

b.Compute the operating income for the Olive Oil Division using a transfer price of $2.14.

c.What transfer price(s)do you recommend? Justify your answer.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: Explain what transfer prices are, and what

Q110: For each of the following transfer price

Q111: Briefly explain each of the three general

Q112: When demand outstrips supply, market prices may

Q113: In a time of distress prices, which

Q114: Transfer prices among divisions within Canada are

Q117: For each of the following transfer price

Q118: For each of the following transfer price

Q119: In the short run, the manager of

Q120: For each of the following transfer price

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents