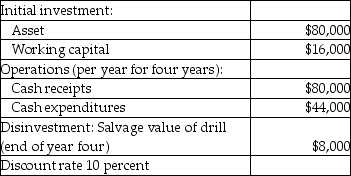

Use the information below to answer the following question(s) .Wet Water Company drills residential and commercial wells.The company is in the process of analyzing the purchase of a new drill.Information on the proposal is provided below:

Note: Other than the initial investment, cash flows are end of period.The working capital is returned at the end of the investment period.

Note: Other than the initial investment, cash flows are end of period.The working capital is returned at the end of the investment period.

-Brown Corporation recently purchased a new machine for $339,013.20.The new equipment has a useful life of 10 years.Net cash flows will be $60,000 per year, end of year payments.What is the internal rate of return?

A) 10 percent

B) 12 percent

C) 14 percent

D) 16 percent

E) 18 percent

Correct Answer:

Verified

Q24: If the net present value analyses of

Q25: An advantage of the internal rate of

Q26: The net present value method can on

Q27: When the present value of expected cash

Q28: Discounted cash flow measures the cash inflows

Q30: Discounted cash flow methods measure all the

Q31: The discount rate, hurdle rate, or (opportunity)cost

Q32: The primary advantage of the internal rate

Q33: A capital budgeting project will have a

Q34: The required rate of return is the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents