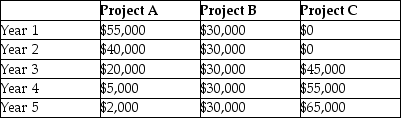

Lion Enterprises Inc.is evaluating 3 investment alternatives.Each alternative requires a cash outflow of $102,000.The cash inflows are summarized below (ignore taxes):

The company has a required rate of return of 9%.Required:

The company has a required rate of return of 9%.Required:

Evaluate and rank each alternative using net present value (NPV).

Correct Answer:

Verified

NPV = $2,411.57

CF0 - $102,000...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: Answer the following questions using the information

Q62: Use the information below to answer the

Q63: Use the information below to answer the

Q64: Use the information below to answer the

Q65: Use the information below to answer the

Q68: Pluto Medical Ltd.is considering purchasing ultrasound equipment

Q69: Anderson Equipment Manufacturing produces equipment for the

Q70: Use the information below to answer the

Q71: What conflicts can arise between using discounted

Q72: Toys and Junk Company is evaluating a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents