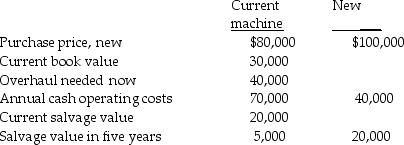

EIF Manufacturing company needs to overhaul its drill press or buy a new one.The facts have been gathered, and are as follows:

Required:

Required:

Based on present value analysis, which alternative is the most desirable with a current required rate of return of 20 percent? Show cash flows, ignore tax effect.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q125: Depreciation charges

A)are not relevant in capital budgeting

Q126: In capital budgeting decisions, relevant cash flows

A)are

Q127: Explain why the term tax shield is

Q128: Windpower Systems Maintenance Ltd.purchased a CCA Class

Q129: Merkel Manufacturing company needs to overhaul its

Q131: A company is considering purchasing new equipment.The

Q132: The initial investment in working capital is

Q133: Johnson's Mini Mart is considering the purchase

Q134: Which of the following is NOT a

Q135: In determining whether to keep a machine

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents