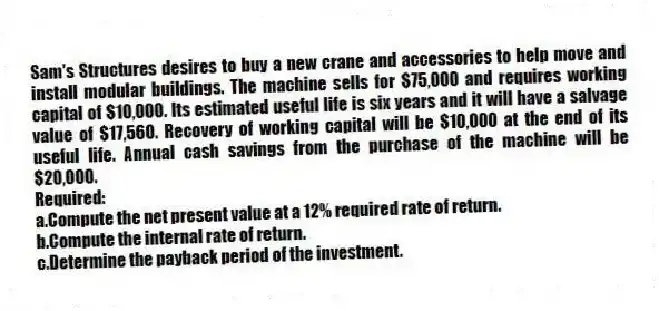

Sam's Structures desires to buy a new crane and accessories to help move and install modular buildings. The machine sells for $75,000 and requires working capital of $10,000. Its estimated useful life is six years and it will have a salvage value of $17,560. Recovery of working capital will be $10,000 at the end of its useful life. Annual cash savings from the purchase of the machine will be $20,000.

Required:

a.Compute the net present value at a 12% required rate of return.

b.Compute the internal rate of return.

c.Determine the payback period of the investment.

Correct Answer:

Verified

b.Trial and error is required. Bec...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q93: Cedile Trailer Supply has received three proposals

Q94: Pearl Manufacturing Company provides glassware machines for

Q95: Which of the following is the numerator

Q96: A weaknesses of the payback method is

Q97: Book & Bible Bookstore desires to buy

Q99: Accrual accounting rate of return is calculated

Q100: Unlike the payback method, which ignores cash

Q101: The Venoid Corporation has an annual cash

Q102: The accrual accounting rate-of-return method has a

Q103: A company is looking to purchase and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents