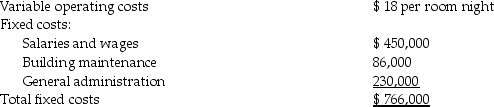

Larry Bett is considering building a budget hotel that offers clean small rooms with bathrooms.He anticipates that his 120 rooms will rent for 36,000 room-nights per year.The market price for equivalent rooms is $60 per night.Larry estimates that the capital cost will be $7,900,000 and he would like an annual return of 15%.Following are the estimated annual operating costs:

Required:

Required:

a.What is the full cost per room-night?

b.Can Larry meet the targeted return on investment based on the estimated costs and revenue? Show your calculations.

c.A tour operator has offered $30 per night for 20 rooms during a time of the year that there is likely to be at least that many rooms vacant.Should Larry accept this offer?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: Relevant costs for pricing decisions include manufacturing

Q24: Answer the following question(s)using the information below.Welch

Q25: Companies that produce high quality products do

Q26: Answer the following question(s)using the information below.Welch

Q27: Schlickau Company manufactures basketball backboards.The following information

Q28: At a management meeting, you just finished

Q30: Delgreco Products manufactures high-tech cell phones.Delgreco Products

Q31: Profit margins are often set to earn

Q33: Backwoods Incorporated manufactures rustic furniture.The cost accounting

Q34: Janice Long is considering building a budget

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents