Lionel Corporation manufactures two products,Product B and Product H.Product H is of fairly recent origin,having been developed as an attempt to enter a market closely related to that of Product B.Product H is produced on an automated production line.

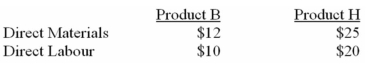

Overhead is currently assigned to the products on the basis of direct labour hours.The company estimated it would incur $450,000 in manufacturing overhead costs and produce 7,500 units of Product H and 30,000 units of Product B during the current year.Unit costs for materials and direct labour are:

Required:

Required:

a)Compute the predetermined overhead rate under the current method of allocation,and determine the unit product cost of each product for the current year.

b)The company's overhead costs can be attributed to four major activities.These activities and the amount of overhead cost attributable to each for the current year are given below:

B.Product H is the more complex of the two products,requiring two hours of direct labour time per unit to manufacture,compared to one hour of direct labour time for Product

Correct Answer:

Verified

Using the data above and an activity-b...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: In activity-based costing, as in traditional costing

Q10: Activity-based costing is a costing method that

Q19: In general, duration drivers are more accurate

Q97: Organization-sustaining activities are carried out regardless of

Q98: Activity rates in activity-based costing are computed

Q102: Huish Awnings makes custom awnings for homes

Q103: Goel Company,a wholesale distributor,uses activity-based costing for

Q105: Ingersol Draperies makes custom draperies for homes

Q106: Hasty Hardwood Floors installs oak and other

Q121: Activity-based-costing (ABC)charges products for the cost of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents