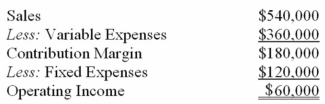

Belli-Pitt,Inc produces a single product.The results of the company's operations for a typical month are summarized in contribution format as follows:

The company produced and sold 120,000 kilograms of product during the month.There were no beginning or ending inventories.

Required:

a)Given the present situation,compute

1 The break-even sales in kilograms.

2 The break-even sales in dollars.

3 The sales in kilograms that would be required to produce operating income of $90,000.

4 The margin of safety in dollars.

b)An important part of processing is performed by a machine that is currently being leased for $20,000 per month.Belli-Pitt has been offered an arrangement whereby it would pay $0.10 royalty per kilogram processed by the machine rather than the monthly lease.

1 Should the company choose the lease or the royalty plan?

2 Under the royalty plan,compute the break-even point in kilograms.

3 Under the royalty plan,compute the break-even point in dollars.

4 Under the royalty plan,determine the sales in kilograms that would be required to produce operating income of $90,000.

Correct Answer:

Verified

Q13: If two companies produce the same product

Q120: Junsin Corporation's budget for next

Q123: Dr.Bertin performs a certain routine surgical procedure

Q131: The following is Arkadia Corporation's contribution format

Q132: Spencer Company's most recent monthly contribution format

Q132: The basic cost-volume-profit model assumes no change

Q134: The following monthly budgeted data are available

Q137: The following monthly budgeted data is available

Q138: Kilimanjaro Company (KC)makes and sells one product:

Q140: Tanner Company's most recent contribution format income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents