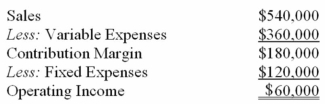

Belli-Pitt,Inc produces a single product.The results of the company's operations for a typical month are summarized in contribution format as follows:

The company produced and sold 120,000 kilograms of product during the month.There were no beginning or ending inventories.

Required:

a)Given the present situation,compute

1 The break-even sales in kilograms.

2 The break-even sales in dollars.

3 The sales in kilograms that would be required to produce operating income of $90,000.

4 The margin of safety in dollars.

b)An important part of processing is performed by a machine that is currently being leased for $20,000 per month.Belli-Pitt has been offered an arrangement whereby it would pay $0.10 royalty per kilogram processed by the machine rather than the monthly lease.

1 Should the company choose the lease or the royalty plan?

2 Under the royalty plan,compute the break-even point in kilograms.

3 Under the royalty plan,compute the break-even point in dollars.

4 Under the royalty plan,determine the sales in kilograms that would be required to produce operating income of $90,000.

Correct Answer:

Verified

Q121: Sales = Variable expenses + Fixed expenses

Q127: P.Harrison Limited manufactures and sells highly faddish

Q136: A company with a degree of operating

Q388: Kilimanjaro Company (KC)makes and sells one product:

Q389: Spencer Company's most recent monthly contribution format

Q390: The following is Alsatia Corporation's contribution format

Q391: The following monthly data are available for

Q392: The following monthly budgeted data is available

Q394: The following monthly budgeted data are available

Q396: The following is Arkadia Corporation's contribution format

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents