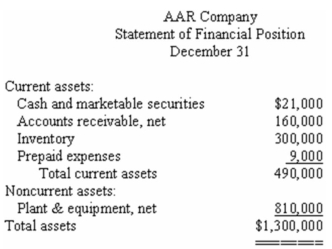

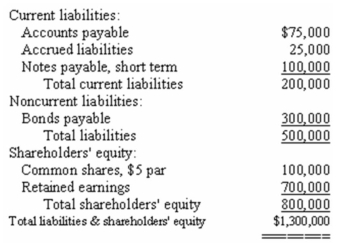

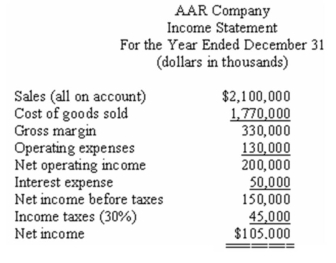

Financial statements for AAR Company appear below:

AAR Company paid dividends of $3.15 per share during the year.The market price of the company's common shares at December 31 was $63 per share.Total assets at the beginning of the year were $1,100,000,and total shareholders' equity was $725,000.The balance of accounts receivable at the beginning of the year was $150,000.The balance in inventory at the beginning of the year was $250,000.

Required:

Calculate the following:

a)Current ratio.

b)Acid-test (quick)ratio.

c)Average collection period (age of receivables).

d)Inventory turnover.

e)Times interest earned.

f)Debt-to-equity ratio.

g)Dividend payout ratio.

h)Price-earnings ratio.

i)Return on total assets.

j)Return on common shareholders' equity.

k)Was financial leverage positive or negative for the year? Explain.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q190: Shelzo Inc. ,a manufacturer of construction equipment

Q191: Condensed financial statements of Miller Company at

Q193: Financial statements for Praeger Company appear below:

Q193: A positive fully diluted earnings per share

Q194: M.K.Berry is the managing director of CE

Q195: When calculating the acid-test ratio,prepaid expenses are

Q195: Financial statements for Lowe Company appear below:

Q198: Financial statements for Sarosa Company appear below:

Q199: Financial statements for Rarig Company appear below:

Q200: Comparative financial statements for Springville Company for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents