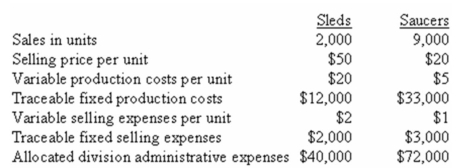

The Winter Products Division of American Sports Corporation produces and markets two products for use in the snow: Sleds and Saucers.The following data were gathered on activities last month:

Required:

a.Prepare a segmented income statement in the contribution format for last month,showing both "Amount" and "Percent" columns for the division as a whole and for each product.

b.Why might it be very difficult to calculate separate break-even sales for each product?

c.Refer to the original data and,if necessary,the results of the segmented income statement prepared in part (a)above.Calculate the total break-even sales (in both units AND dollars)for last month,assuming that none of the fixed production costs and fixed selling expenses is traceable.Allocate the total break-even sales between the two products.

d.Again,refer to the original data and,if necessary,the results of the segmented income statement prepared in part (a)above.Calculate the total break-even sales (in both units AND dollars)for last month,assuming that the "allocated" amounts of the division's administrative expenses are fixed and actually traceable.Allocate the total break-even sales between the two products.

e.How reasonable are the total break-even sales numbers calculated in parts (c)and (d)given the actual results for last month?

Correct Answer:

Verified

b.All fixed expenses have to be tra...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: Segmented statements for internal use should be

Q146: Some managers believe that residual income is

Q158: Since the sales figure is neutral in

Q164: Financial data for Beaker Company for last

Q167: When an intermediate market price for

Q176: Internal failure costs result when a

Q178: Granting subordinates autonomy and profit responsibility almost

Q179: Assuming that a segment has both variable

Q180: An increase in appraisal costs will

Q183: Describe the balanced scorecard concept and explain

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents