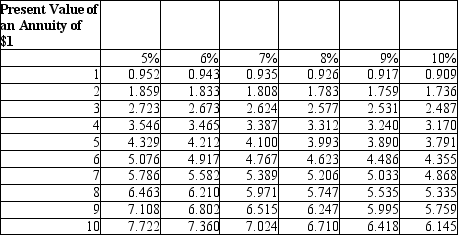

Dakka Company is considering an investment of $500,000 in a financial instrument that is expected to return cash flows of $80,000 a year for 10 years. The operations manager says that it is a "no-brainer" because the total cash flows are $800,000, and it has a payback of just over six years. The VP Finance expresses caution. He says that because Dakka uses a 10% hurdle rate, a more thorough analysis may show that the investment does not qualify under the company's investment criteria. Considering the information provided, the company should reject the investment.

Correct Answer:

Verified

Q81: If you invest $3,000 today at 7%

Q82: Juan has just received a prize which

Q86: Wilhelmina has just received an inheritance of

Q87: Amanda is ready to retire and as

Q88: If you invest $1,000 at the end

Q89: Simms Manufacturing is considering two alternative investment

Q90: Net present value is defined as the

Q92: If a company uses a higher discount

Q94: Julio has just received a legal judgment

Q96: Jim wants to invest $5,000 a year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents