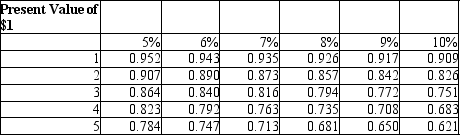

Allied Chemicals has a hurdle rate of 9% for new investments. The production manager suggests that an equipment upgrade costing $84,460 would yield net cash flows of $40,000 in the first year, $30,000 in the second year, $20,000 in the third year, and $10,000 in the fourth and final year.

The investment meets the company's hurdle rate requirement and should be adopted.

The investment meets the company's hurdle rate requirement and should be adopted.

Correct Answer:

Verified

Q98: Amanda is ready to retire and as

Q99: Jim wants to invest $5,000 at the

Q100: Julio has just received a legal judgment

Q104: A company has policy to invest in

Q104: Which of the following is TRUE of

Q107: The rate of return and payback methods

Q109: Considering the four common methods of evaluating

Q111: When calculating the net present value of

Q113: An investment would be considered a good

Q116: Compound interest used in discounted cash flow

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents