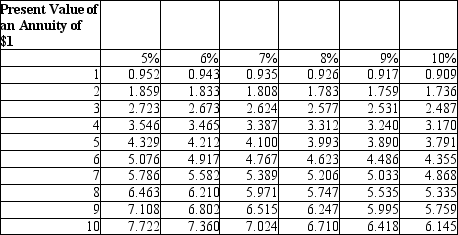

Centurion Company is considering a mineral extraction project which requires an initial investment of $2,000,000 and will yield annual cash flows of $300,000 for 8 years. Centurion has an 8% hurdle rate. What is the NPV of the project?

A) Positive $275,900

B) Negative $275,900

C) Positive $103,184

D) Negative $240,000

Correct Answer:

Verified

Q105: The term net present value means the

Q132: Please review the information on 4 potential

Q133: Which of the following would be the

Q135: Alpha Company is considering an investment of

Q136: When comparing several investments with the same

Q137: Which of the following best describes the

Q137: Please refer to the following data concerning

Q139: Please refer to the following data concerning

Q140: Please review the information on 4 potential

Q141: Carte Blanco Company is evaluating an investment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents