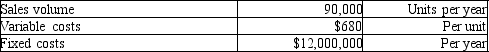

Maxi Production is a price-taker. They produce large spools of electrical wire in a highly competitive market, and so they practice target pricing. The current market price is $800 per unit. The company has $2,000,000 in assets and shareholders expect a return of 5% on assets. The company provides the following information:  Currently the cost structure is such that the company cannot achieve its profit objective and must cut costs. If fixed costs cannot be reduced, how much reduction in total variable costs will be needed to achieve the profit target?

Currently the cost structure is such that the company cannot achieve its profit objective and must cut costs. If fixed costs cannot be reduced, how much reduction in total variable costs will be needed to achieve the profit target?

A) Reduce variable costs by $1,300,000

B) Reduce variable costs by $1,050,000

C) Reduce variable costs by $990,000

D) Reduce variable costs by $1,200,000

Correct Answer:

Verified

Q43: Able Specialty Foods sells jars of special

Q47: Perfect Time Company manufactures and sells watches

Q56: Burr Hill golf course is planning for

Q59: Outdoor Recworld produces a special kind of

Q60: Polynesian Products sells 1,800 kayaks per year

Q62: Potlatch Company manufactures sonars for fishing boats.

Q63: Potlatch Company manufactures sonars for fishing boats.

Q64: DM Corporation has provided you with the

Q65: The income statement for Sweet Dreams Company

Q66: A company has two different products that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents