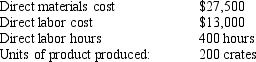

Arabica Manufacturing Company uses a predetermined manufacturing overhead rate based on a percentage of direct labor cost. At the beginning of 2012, they estimated total manufacturing overhead costs at $1,050,000, and they estimated total direct labor costs at $840,000. In June, 2012, Arabica completed job number 511. Job stats are as follows:  How much manufacturing overhead was allocated to the job?

How much manufacturing overhead was allocated to the job?

A) $16,250

B) $10,400

C) $5,000

D) $34,375

Correct Answer:

Verified

Q41: Halcyon Company just completed job number 10-B.

Q42: Gardner Machine Shop estimates manufacturing overhead costs

Q44: When calculating the predetermined manufacturing overhead rate,

Q45: Halcyon Company just completed job number 10B.

Q48: Arabica Manufacturing Company uses a predetermined manufacturing

Q50: Which of the following describes the allocation

Q50: Inglesias Company just completed job number 12.

Q54: Falstaff Products estimates manufacturing overhead costs for

Q58: Which of the following correctly describes the

Q59: Gardner Machine Shop estimates manufacturing overhead costs

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents